“Stay updated with the latest KIBOR (Karachi Interbank Offered Rate) in Pakistan. Check today’s KIBOR rate for Weekly (1 ,2) Monthly (1,3,6,9) and 1 Yearly . Accurate and reliable financial updates for better decision-making.”

The Karachi Interbank Offered Rate (KIBOR) is a benchmark interest rate used by banks and financial institutions in Pakistan to lend money to one another. KIBOR plays a crucial role in determining loan and financing rates for businesses and individuals. Staying updated with the latest KIBOR rates can help you make informed financial decisions, whether you’re a business owner, investor, or borrower.

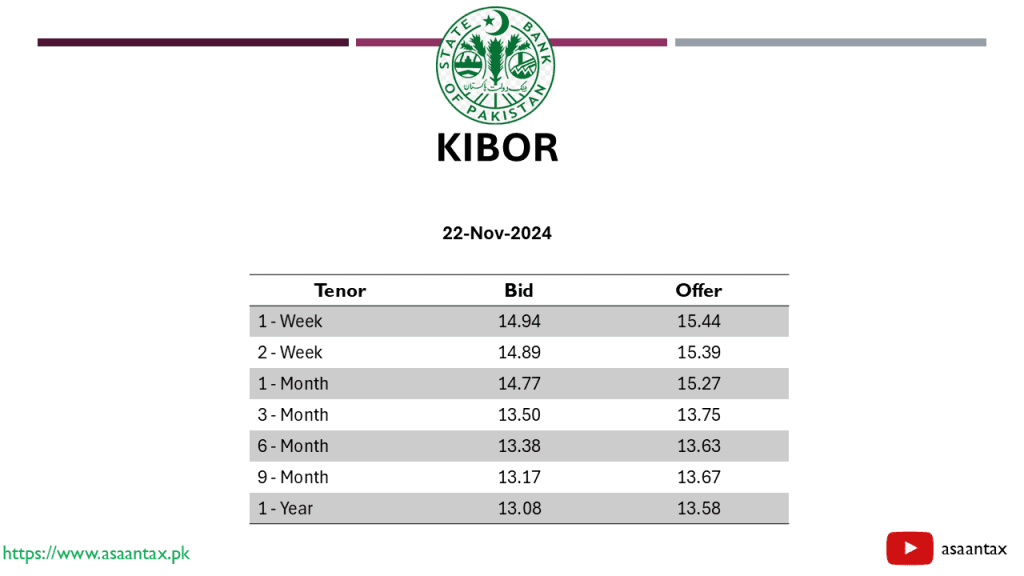

What Are Today’s KIBOR Rates?

As of [Insert Date], the current KIBOR rates are as follows:

- 1-Week KIBOR Rate: [15.44]

- 2-Week KIBOR Rate: [15.39]

- 1-Month KIBOR Rate: [15.27]

- 3-Month KIBOR Rate: [13.75]

- 6-Month KIBOR Rate: [13.63]

- 9-Month KIBOR Rate: [13.67]

- 1-Year KIBOR Rate: [13.58]

These rates are regularly updated and published by the State Bank of Pakistan (SBP). You can always refer to the official SBP KIBOR page for the most accurate and real-time information.

Why Is KIBOR Important?

KIBOR serves as a key indicator for:

- Determining loan and financing costs.

- Helping businesses plan investments and working capital.

- Offering insights into the country’s economic conditions.

Stay informed about the latest KIBOR rates with our daily updates, and explore more insights about Pakistan’s banking and financial sector in our finance section.

How does Kibor affect our economy?

The Karachi Interbank Offered Rate (KIBOR) significantly impacts Pakistan’s economy as it acts as a benchmark interest rate that influences various aspects of financial and economic activity. Here’s how KIBOR affects the economy:

1. Lending and Borrowing Costs

- Businesses and Corporations: KIBOR is used by banks to set interest rates for corporate loans. A higher KIBOR rate increases borrowing costs for businesses, which can affect their operations, investment decisions, and expansion plans.

- Consumers: Personal loans, car financing, and housing loans are also linked to KIBOR. A higher rate means higher EMIs (Equated Monthly Installments), reducing disposable income and spending.

2. Investment and Economic Growth

- Impact on Investments: High KIBOR discourages borrowing, leading to reduced investment in industries and infrastructure, slowing down economic growth. Conversely, a lower KIBOR encourages borrowing, fostering growth and development.

- Foreign Direct Investment (FDI): Stable and competitive KIBOR rates attract foreign investors looking for predictability in financing costs.

3. Inflation Control

- Inflation Targeting: The State Bank of Pakistan adjusts monetary policy, influencing KIBOR to control inflation.

- When inflation is high, KIBOR rates are increased to reduce borrowing and curb spending.

- When inflation is low, rates are lowered to stimulate borrowing and spending.

4. Banking Sector and Liquidity

- Profit Margins: Banks use KIBOR to determine profit margins on loans. A stable KIBOR ensures healthy profitability for banks.

- Liquidity Management: KIBOR fluctuations impact liquidity in the banking system, affecting how banks manage their reserves and lending practices.

5. Foreign Exchange and Investments

- Attracting Foreign Capital: A higher KIBOR can attract foreign investors to invest in Pakistan’s financial instruments, strengthening the rupee. However, excessively high rates can deter long-term investments.

- Currency Stability: KIBOR impacts the flow of foreign exchange, influencing the balance of payments and overall currency stability.

6. Stock Market Performance

- Impact on Stocks: A higher KIBOR discourages investments in the stock market as fixed-income instruments become more attractive. This can lead to reduced liquidity and slow stock market growth.

7. Government Debt Management

- Impact on Borrowing: Government borrowing through Treasury bills and bonds is linked to KIBOR. Higher rates increase the cost of servicing debt, putting pressure on the fiscal budget.