Kibor Rates Daily and Their Impact on Financial Markets

KIBOR Rates (Karachi Interbank Offered Rate) plays a crucial role in Pakistan’s financial sector, serving as a widely used interest rate benchmark. It is determined daily based on the rates at which banks lend to one another, making it a key reference for various financial products, including loans and investments.

What is a Benchmark?

A benchmark is a standard or reference point used for comparison in various industries, including finance, economics, and business performance. It helps measure the efficiency, performance, or effectiveness of a system, investment, or financial rate.

What a Difference between KIBOR as a Benchmark Rate

KIBOR is not just a lending rate; it is a benchmark rate (1 year) and benchmark rate (3 months) that financial institutions use to set interest rates for various financial products. For businesses and individuals, these benchmarks determine the cost of borrowing and influence investment decisions.

KIBOR Rates of Different Banks in Pakistan

The KIBOR rates of different banks in Pakistan may vary slightly based on liquidity and demand-supply factors in the interbank market. However, the State Bank of Pakistan (SBP) monitors and regulates these rates to maintain market stability.

KIBOR with BID

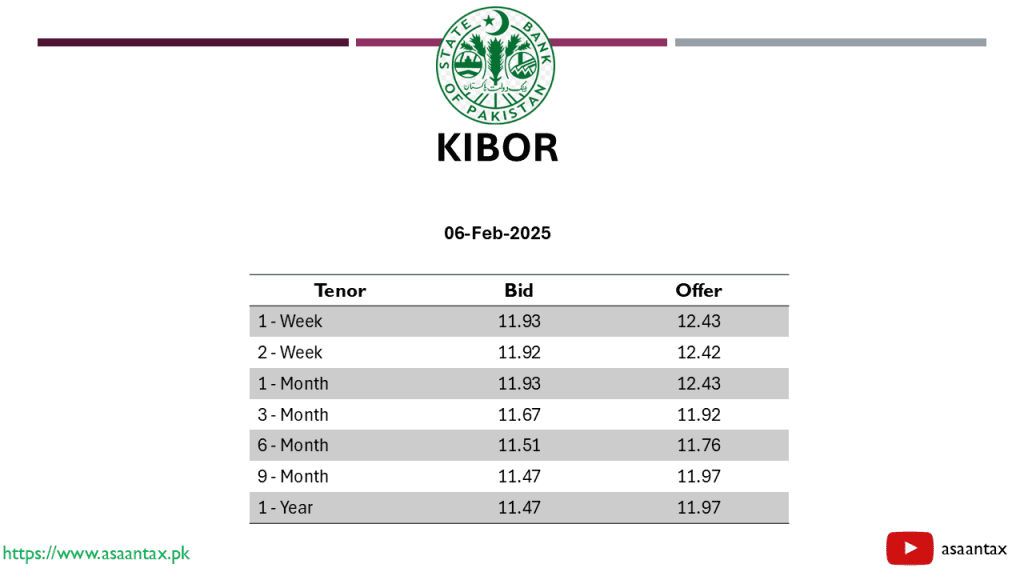

Financial institutions apply KIBOR based on specific timelines:

| Tenor | BID |

| 1 – Week | 11.93 |

| 2 – Week | 11.92 |

| 1 – Month | 11.93 |

| 3 – Month | 11.67 |

| 6 – Month | 11.51 |

| 9 – Month | 11.47 |

| 1 – Year | 11.47 |

The application of KIBOR rates with BID refers to how banks use both the Karachi Interbank Offered Rate (KIBOR) and Karachi Interbank Bid Rate (KIBID) in financial transactions. Here’s a breakdown:

| Tenor | OFFER |

| 1 – Week | 12.43 |

| 2 – Week | 12.42 |

| 1 – Month | 12.43 |

| 3 – Month | 11.92 |

| 6 – Month | 11.76 |

| 9 – Month | 11.97 |

| 1 – Year | 11.97 |

Standardized Benchmark for Interest Rates

IBOR acts as a reference rate for financial institutions when setting lending and borrowing rates. This ensures transparency and consistency in financial transactions across Pakistan’s banking system.

Influence on Loan and Financing Costs

Businesses and individuals taking loans—such as corporate financing or personal mortgages—often have their interest rates pegged to KIBOR.

Banks set lending rates as KIBOR + a fixed margin, making it a key factor in determining loan affordability.